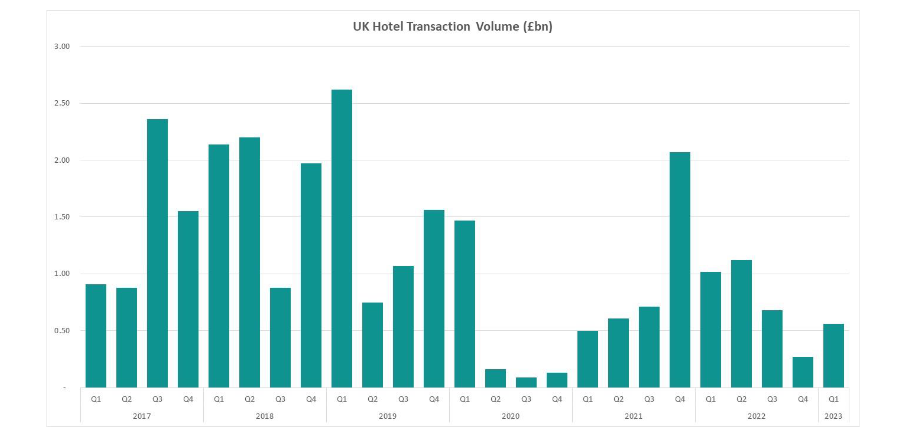

– UK Hotel transaction volumes reached almost £0.6 billion for the first quarter of the year –

After a muted end to 2022, transactional activity during the first three months of the year more than doubled, compared to the previous quarter, but with the deal volume remaining significantly below the five-year quarter average of £1.2 billion.

The deals completed were exclusively single asset transactions, with a dearth of portfolio activity, but with a 50:50 split between regional UK and London completed sales. UK corporate investors were most active in terms of seller, accounting for over 40% of transactions, whilst a furth er 23% of the activity was attributed to investment sales completed by UK institutional investors . Those buyers most active were experienced hotel owners with a profound understanding and knowledge of the UK hotel sector, be it focused hotel investment groups or corporate hotel owner operators.

Operationally, the UK hotel market continues to perform strongly, with investors buoyed by RevPAR returning to, or exceeding pre-pandemic levels. Investment in the sector has been fuelled by robust levels of domestic travel, comprising strong leisure, and improving corporate demand, which have yielded often longer and more profitable stays.

The London hotel market has seen five sizeable transactions take place during the first three months of the year. Hotels which transacted included the £55 million sale of The Covent Garden Hotel, acquired by Firmdale from CBRE Investment Management; Dalata Hotel Group’s £44 million purchase of a newly built, 192-room hotel in Seven Sisters; and the £42 million sale of the long-leasehold interest of the Holiday Inn Regents Park Hotel, divested by CBRE Investment Management.

Despite interest rates continuing to rise and inflation now expected to fall more slowly than the initial Bank of England forecast, investment appetite in the hotel sector is expected to remain resilient, with London and key gateway cities remaining key targets. Various quality assets currently being marketed for sale include The Sheraton Grand Hotel & Spa, Edinburgh with a guide price of more than £100 million and the £450 million sale of the three London-based Hoxton hotels.

Meanwhile, lucrative Home Office contracts are having a material structural impact on the UK hotel market, in terms of both the occupational and investment market. According to Knight Frank research, we estimate that across the whole of the UK, some 350 hotels totalling approximately 35,000 rooms are currently being used to house asylum seekers and refugees or commissioned for use as social housing. This reduction in a market’s total capacity of bedroom stock is supporting the sector’s recovery. Meanwhile, the dynamics of the investment market are also being impacted by these Home-Office contracts with far fewer distressed or forced sales currently taking place.

Philippa Goldstein, Senior Analyst – Hotels & Leisure at Knight Frank, comments: “With interest rates remaining high, access to finance and the cost of debt will continue to make certain investors more reticent. Yet, large amounts of capital remain to be deployed, and with investors taking a long-term view, the outlook for increasing levels of investment into the sector is positive, with potential for both portfolio and big-ticket single asset deals to take place later in the year.”

Henry Jackson, Head of Hotel Agency, and Partner at Knight Frank commented: “Having traded strongly over the past 12 months, we are beginning to see more sizeable, prime located assets, benefit from a competitive sales process, demonstrating resilience in pricing. Due to the ongoing rise in the cost of debt, the requirement for higher returns from certain buyer profiles provides an opportunity for other investors to gain a foothold into the market.

“Whilst there continues to be a continuing lack of distress in the market, increased activity from owners actively managing their portfolios is apparent. Owners are now more willing to realise the value of their assets, to free up capital to support the increased burden of debt, or for reinvestment through repositioning and ESG improvements, or for continued expansion.”

For further information about the Firm, please visit knightfrank.com.