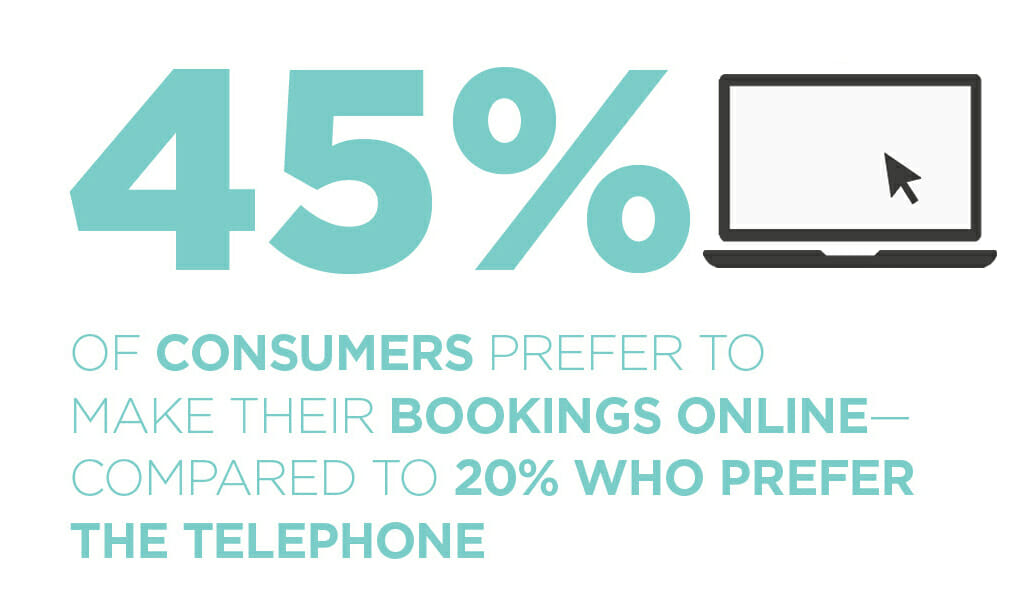

For the first time ever, booking a table online has overtaken telephone reservations, according to the latest GO Technology report from Zonal. Research by Zonal and CGA of 5,000 UK adult consumers shows that 45% of consumers now prefer to make their booking online, compared to just 20% who use the telephone. This is a radical change from four years ago, when well over half (58%) of consumers preferred to make table bookings by telephone.

Zonal’s Commercial Director, David Charlton, said: “We live in a digital age, where web booking has become part of everyday life for connected generations. Offering an online booking service is no longer a luxury for brands, it’s a given. Consumers expect to make reservations on the go 24/7 from their mobile device and they are not keen on phoning a venue to do so.”

For almost half (49%) of those planning to go out for a drink or bite to eat, the ability to pre-book is important. And for those that do pre-book the average number of eating brands in their repertoire is 8.1 compared to 6.7 who don’t.

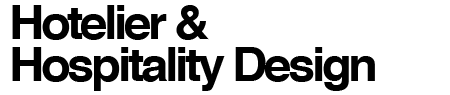

Payback for brands that offer a good online booking service is proven, as the average monthly spend on eating and drinking increases to £87.83 compared to just £74.68 for those that don’t pre-book.

However, brands do need to make sure they fulfil the expectations of those that have pre-booked. The biggest complaint for pre-bookers is a table not being available at the time they booked (37%), closely followed by having to queue to get in (35%) and spaces or tables being occupied when they arrive (34%).

Being asked to pay a deposit for a booking is a source of irritation for customers, with one in five (21%) citing this as a major annoyance, which rises to 25% for 18 to 34 year olds.

When it comes to group bookings, GO Technology suggests they are more prepared to pay a deposit. Consumers in a group of fewer than eight say they are willing to pay an average of £4.55 per head for a midweek restaurant table, but those in larger groups will pay £6.04. That indicates an acceptance that as group size grows, so should the deposit. It also suggests larger groups value the confidence that by paying a deposit, their booking is secured.

“We recognise there is an industry wide issue of no-shows, so requesting a deposit is one way of tackling the problem. However, ask for too much and consumers may go elsewhere and ask for too little and the risk of no-shows increases. Our GO Technology research finds that there is elasticity in what consumers will pay; they accept they should pay more on busy days or peak times, and on special occasions like Christmas or Valentine’s Day. The ability to flex deposit levels according to demand is crucial,” added David.

When asked what they would like to see when booking, the number one consumer choice is the ability to reserve a specific table, booth or area (42%). Getting their favourite space or a table with a view is more likely to leave guests satisfied with their visit, and more likely to return.

Karl Chessell, CGA Business Unit Director, Retail and Food, said: “Pub, bar and restaurant customers increasingly see booking as a necessary part of their eating and drinking experiences. Large groups, celebrations and the fear of missing out on popular places are all fuelling the trend, and more and more people value the security and reassurance that a confirmed reservation and deposit provide.”

When it comes to targeted marketing campaigns, women are more likely to pre-book (53%). They are also more likely than average to pre-book for celebrations and special occasions and more likely to seek specific tables or areas in a venue.

Not surprisingly, parents also over-index when it comes to pre-booking. They make up a third (35%) of the booking cohort, but only a quarter (27%) of those who never pre-book. This is because family groups tend to be larger, and because parents are anxious for a smooth experience when they have children in tow.

To access a copy of the full report visit www.zonal.co.uk