Two bumper hotel transactions have kicked 2024 off to a strong start amid a narrowing gap between buyer and seller price expectations.

In January, Starwood Capital acquired the 10-hotel Radisson Edwardian portfolio for a reported £800 million, most of which is in central London, while Travelodge also acquired over 60 properties for around £210 million, including assets in London amongst other regional assets. Such activity signals that buyers and sellers could be more aligned in terms of pricing expectations compared to 2023.

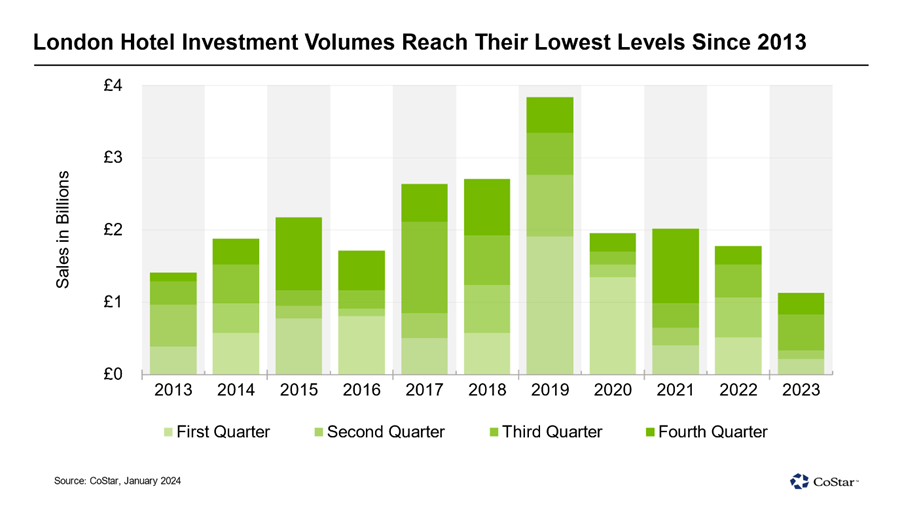

London hotel investment volumes hit their lowest in the past decade as the increased cost of debt and uncertainty around interest rate stability put many deals on hold. Additionally, sellers remained reluctant to discount on price given strong trading results throughout 2023, influencing limited stock availability.

Total transaction volumes amounted to just over £1 billion in 2023, approximately 36% below the prior year and about 70% lower than the previous peak in 2019. Trades in London accounted for nearly half of total UK volumes as a lack of major portfolio deals kept activity somewhat subdued.

The return of sizeable deals towards the end of 2023 may suggest a turning point in the market with stakeholders seeing more alignment in the deal structure, however. Archer Capital B.V. acquired two Hoxton hotels – Shoreditch and Holborn – totalling 430 rooms for approximately £213 million (£494,000/room) in December. The new owners highlighted that the properties do not require significant capital expenditure, thus enabling them to diversify their portfolio which already contains various capital-intense investments.

Value-add purchases remain a priority, nonetheless, with foreign buyers having a robust appetite for such opportunities. The past year saw a few deals trade in London which are currently undergoing major works with potential upside value.

KOP Limited’s acquisition of the freehold of the former 103-room Best Western Burns Hotel for approximately £30 million (£291,000/room), reflecting a 5% discount on the guide price, with the aim to reposition it under its Montigo Resorts brand due to open in Q1 2024 is a prime example. Similarly, Orca Holdings acquired the long leasehold interest of two former Grange hotels – the 58-room White Hall and the 26-room Blooms hotel – for an undisclosed sum, supported by a £26 million loan from Bank Leumi to also refurbish the two assets. Both properties are expected to be merged into one and rebranded to a 72-room Zetter hotel, expected to open in 2025.

Budget properties have also been on investors’ radars as over £120 million transacted in 2023. Premier Inn and Travelodge branded assets continue to be favoured given their strong covenants and robust trading performance, while some acquisitions were geared towards repurposing to other uses. Cerberus Capital Management acquisition of the Barkston Rooms hostel in Earl’s Court is a noteworthy example. The property was acquired for £20.5 million, and it is expected to be converted into seven private residences, with the new owners having planning permission to do so.

Interest rate cut prospects could support deal volumes as the year progresses, with the bid-ask gap narrowing too. Core markets such as London will remain sought after as the city tends to be more resilient through challenging macroeconomic times, while its global appeal and position as a financial, political, and cultural centre translates in all-year round demand, which should support stable trading growth and continue to attract foreign investors.